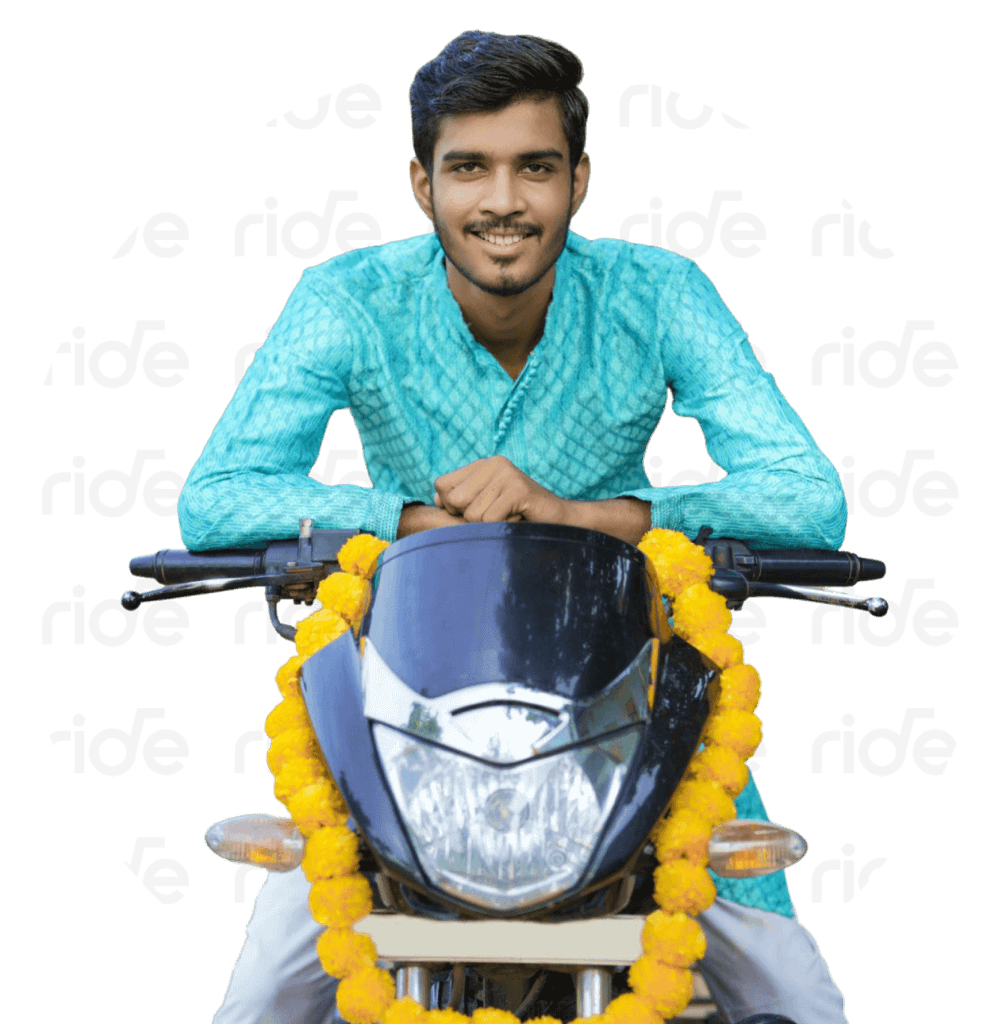

Finance for two wheelers

Getting a two wheeler loan has never been easier. From commuter bikes to zippy scooters and sporty motorcycles, finance for your favorite two-wheeler is just a click away.

Benefits & Features

Easy Documentation

Spot Approval

No Hidden Costs

Attractive Interest Rates

Documents

Aadhaar Card is mandatory

Identity Proof

(Any one of the following)

- Passport

- Driving License

- Voter ID

- Pan Card

Address Proof

(Any one of the following)

- Passport

- Driving License

- Gas Bill With Gas Book

Other Requirements

(Any one of the following)

- Recent Passport size colour photographs

- Income Proof Documents

- Bank Statement for the last six months

- One cancelled Cheque and ACH form for Electronic Clearing Mandate

- Duly endorsed Vehicle Registration Certificate on receipt for New Vehicles

Avail Easy and Quick Loans for New and Used Two Wheelers

Ride Finance is committed to customer satisfaction through transparent processes, on-time funding, and a fully functioning customer support system.

FAQS

Can I get a 100% bike loan?

Yes, you can avail up to 90% of the bike amount as a two wheeler loan.

Can anyone get a bike loan?

Anyone can get a bike loan. But, they must be at least 21 years old and earn a minimum of ₹12,000 per month, and have been working with a company for at least 1 year.

Do I need a guarantor for a two wheeler loan?

If you fulfil the two wheeler loan eligibility criteria, you will not need a guarantor. However, if you think that you do not meet the criteria, you can get one on board. You can also present a guarantor to simply increase your chances of getting the bike loan.

What is the minimum down payment for bike loans?

The minimum down payment for bike loans can be anywhere between 10-15% of the loan amount. It will depend upon the lender. The down payment amount will also depend on the cost of the bike and your own repayment capability.

Can I get a bike loan if I am a student and have no income?

Yes, you can get a bike loan as a student with no income, but you will need to get a guarantor on board. The guarantor, who will become the co-applicant of your bike loan, must fulfill the bike loan eligibility criteria and have a stable source of income.